Your health insurance renewal notice is about to arrive. And if you’re a tech company with fewer than 250 employees, what you’re about to see might shock you.

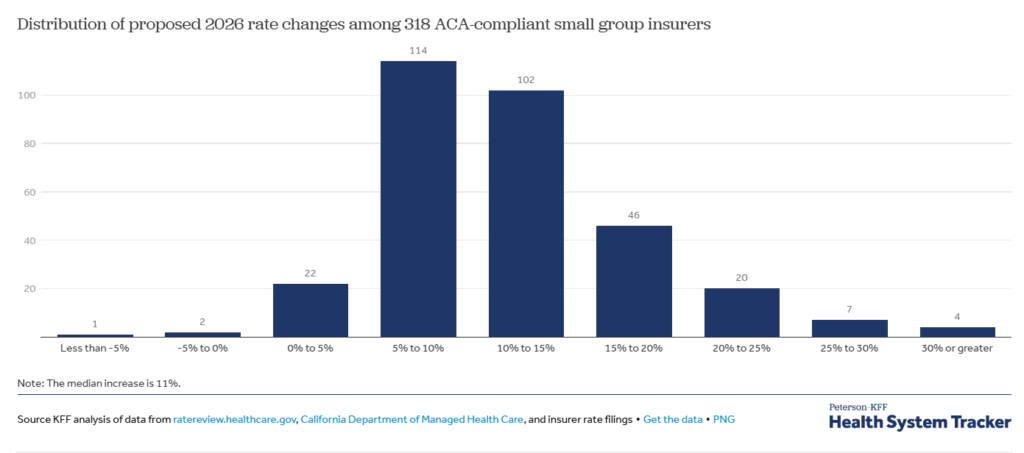

The median proposed premium increase for small group health insurance in 2026 is 11% across 318 insurers in all 50 states and the District of Columbia. But that’s just the median. About 10% of insurers are requesting premium increases of 20% or more, with some proposing rate hikes as high as 32%.

For a 50-person tech company currently paying $7,000 per employee annually, an 11% increase means an additional $38,500 in health insurance costs. A 20% increase? That’s $70,000 more per year, money that could have funded one additional hire or a major product initiative.

Welcome to the 2026 small group health insurance renewal crisis.

The Small Group Market Is in Free Fall

The brutal reality is that the small group health insurance market, covering businesses with 50 or fewer employees, is facing a perfect storm of challenges that are fundamentally reshaping what’s possible for emerging companies.

Why This Year Is Different

Insurers are commonly estimating that the underlying cost of healthcare (medical trend) will increase by about 9% in 2026. But that’s just the starting point. Several converging factors are making 2026 uniquely challenging:

Rising Healthcare Costs Across the Board

Insurers cite rising healthcare costs as the primary driver of premium increases, including higher prices for hospitalizations, physician care, and prescription drugs. But one category stands out: 27 insurers mentioned the impact of GLP-1 medications (like Ozempic and Wegovy) on premiums, with some deciding to exclude coverage of GLP-1s for weight loss purposes in 2026 to mitigate costs.

The Death Spiral Is Real

Insurers point to volatility in the small group market caused by decreases in enrollment and a simultaneous increase in relative costs for the remaining risk pool. Here’s what’s happening: as premiums rise, healthier companies drop coverage or move to alternative arrangements. This leaves a sicker, more expensive pool of companies in the traditional small group market, which drives rates even higher. It’s a vicious cycle.

In New York, enrollment in the small group market continues to shrink at an unsustainable rate, with analysts warning that some areas may be facing a “death spiral” of rising premiums and dropping enrollment.

Carriers Are Abandoning the Market

Perhaps most alarming is that major insurance carriers are simply walking away from small businesses. Aetna is exiting the individual market in 17 states including Arizona, California, Delaware, Florida, Georgia, Illinois, Indiana, Kansas, Maryland, Missouri, Nevada, New Jersey, North Carolina, Ohio, Texas, Utah, and Virginia.

In Connecticut’s small group market, Aetna, Cigna/Oscar Health, Harvard Pilgrim HealthCare, and ConnectiCare have all exited since 2022, leaving just two carriers, Anthem and UnitedHealthcare, providing fully insured plans to small employers.

Fewer carriers means less competition. Less competition means higher prices and fewer options for small businesses.

The Geographic Lottery: Where You Are Matters Enormously

Not all states are experiencing the same pain. Oxford Health Insurance Inc., the largest insurer in NYC and Long Island’s small group markets, has an approved rate increase of 11.8% for 2026, more than twice its 2025 premium increase of 5.3%. Meanwhile, Excellus, the largest insurer in Rochester’s small group market, faces an even higher rate increase of 15.0% for 2026, compared to 10.5% in 2025.

Some regional variations show stark differences in how the crisis is playing out:

- States with limited competition are seeing the most dramatic increases

- Markets where carriers have exited face compounding problems with both higher rates and fewer plan options

- States with stronger regulatory oversight may see slightly moderated increases, but no state is immune

For tech companies with distributed teams, this geographic variation creates additional complexity. Your employees in Florida might face dramatically different rate impacts than those in Colorado.

Why Traditional Health Insurance Renewal Strategies Won’t Work This Year

In past years, you might have navigated renewal season by:

- Shopping around for competitive quotes from multiple carriers

- Negotiating with your broker for better rates

- Adjusting plan design to control costs

- Increasing employee contributions

In 2026, these strategies have limited effectiveness:

Shopping Around Provides Diminishing Returns

With carriers exiting markets and remaining insurers all facing the same cost pressures, the competitive quotes you receive will likely be within a few percentage points of each other, and all significantly higher than your current rates.

Negotiation Room Is Nearly Non-Existent

Only 3 insurers out of 318 have requested rate decreases for 2026. When 99% of the market is increasing rates, your negotiating leverage essentially disappears. Carriers know you have limited alternatives.

Plan Design Changes Hit Employee Satisfaction

You can shift to higher deductibles and out-of-pocket maximums to reduce premiums, but there’s a cost. For 2026, the maximum out-of-pocket costs for ACA-compliant plans will rise to $10,600 for self-only coverage (up from $9,200 in 2025) and $21,200 for family coverage (up from $18,400 in 2025), roughly a 15.2% increase year over year.

Your employees are already facing higher costs. Degrading benefits further could trigger resignations.

Employee Contribution Increases Have Limits

You can only push so much cost onto employees before your benefits package becomes uncompetitive. In competitive tech hiring markets, weak health benefits signal that you don’t value your team, and they’ll find employers who do.

Your Real Options for 2026

Given the grim landscape, what can tech companies actually do? Here are the viable paths forward:

Option 1: Absorb the Increase

For some companies, the simplest path is accepting the health insurance renewal rate increase and absorbing the cost.

When this makes sense:

- You’re highly profitable and can afford the hit to margins

- You’re in the middle of a critical product launch or funding round and can’t afford the distraction

- Your team is very stable and retention isn’t a concern

- You’re planning to exit or sell in the next 12-18 months

The real cost: For a 50-person company facing an 11% increase on $350,000 in annual premiums, you’re looking at an additional $38,500 per year or about $96 per employee per pay period.

Option 2: Explore Professional Employer Organizations (PEOs)

PEOs aggregate multiple small businesses into large pools, giving you access to enterprise-level rates and plan options.

How PEOs handle renewals differently:

PEOs spread risk over a large number of employees among many clients and can offer health insurance at lower costs compared to options available in the open market. They also provide higher levels of predictability and flatten the renewal curve, with anything below 10% considered a strong renewal.

As healthcare and pharmaceutical costs continue to rise, most states are seeing trend increases between 11% and 15% on the open market health insurance plan options. By joining a PEO master plan, many companies can secure renewals in the 6-10% range instead.

The trade-off: You are covered under the PEO’s master plan and hence limited to the plan options that the master plan offers. However, for most companies under 250 employees, you weren’t getting true customization anyway—you were choosing from whatever 2-3 options your broker could negotiate.

Critical considerations:

If your renewal is over 20%, some PEO groups will not want to quote you on their master health plan without having employees complete health questionnaires. Additionally, insurance carriers often put in place a “Parity Rule” on PEO master plans, most commonly capping a health insurance rate reduction to 5% for groups coming from another PEO if the previous PEO had the same health insurance carrier.

This means timing matters. If you wait until you get a brutal renewal to explore PEOs, your options become more limited.

Want to understand more about what switching to a PEO could mean for your company? Learn how Aspireship can help here.

Option 3: Individual Coverage Health Reimbursement Arrangements (ICHRA)

Instead of offering traditional group coverage, you provide employees with a tax-advantaged stipend to purchase individual marketplace plans.

Why this is gaining traction in 2026:

ACA premiums in many regions now closely mirror employer-sponsored plan costs, and in some cities, ACA plans can offer better value. This wasn’t true five years ago, but the convergence creates new opportunities.

The mechanics:

- You set a monthly allowance per employee (e.g., $500/month)

- Employees shop for individual marketplace plans

- You reimburse employees tax-free for their premiums

- Your costs are fixed and predictable

Key advantages:

- Budget predictability: You know exactly what you’ll spend

- Employee choice: Team members select plans that fit their needs

- Geographic flexibility: Works well for distributed teams since plans are purchased locally

Critical challenges:

- Enhanced premium tax credits that have made marketplace coverage affordable are set to expire at the end of 2025, which could increase gross premiums (total cost without subsidies) by an additional 1-7 percentage points in some states.

- Employee education burden: You’ll need to help employees understand how to shop for plans

- Participation requirements: ICHRA has specific rules about who you can offer it to

When this makes sense:

- You have a distributed team across multiple states

- Your team is young and tech-savvy enough to navigate marketplace shopping

- You want cost predictability year over year

Option 4: Level-Funded Plans

A middle ground between fully insured and self-funded plans that can offer savings for companies with healthy populations.

How they work:

- You pay a fixed monthly amount

- Claims are paid from this amount

- If claims are lower than expected, you get money back

- If claims exceed expectations, you have stop-loss insurance

When this makes sense:

- You have 30-100 employees

- Your team is relatively young and healthy

- You’re willing to take on slightly more risk for potential savings

Key risks:

- If your team has higher-than-expected claims, your renewal could be brutal

- Requires more administrative involvement than traditional plans

- Not all states allow these arrangements

The 90-Day Action Plan

Your renewal notice will arrive 60-90 days before your renewal date. Here’s what you should do now:

90 Days Before Renewal

Gather your data:

- Current premium costs and employee contribution amounts

- Census data (ages, locations, coverage elections)

- Claims experience if available

- Employee satisfaction data about current coverage

Explore alternatives proactively: Don’t wait for your renewal notice to start looking. Request quotes from:

- At least 2-3 traditional carriers

- 2-3 PEO providers

- An ICHRA platform if you have distributed teams

60 Days Before Renewal

Run the numbers on multiple scenarios:

- Status quo with rate increase

- Alternative carriers with different plan designs

- PEO options with master plans

- ICHRA with various allowance levels

Model employee impact: How will each option affect employees’ out-of-pocket costs? Create comparison charts showing:

- Monthly premium contributions

- Annual deductibles

- Out-of-pocket maximums

- Specific impacts for different employee profiles (single, family, etc.)

30 Days Before Renewal

Make your decision and communicate:

Whichever direction you choose, communicate early and transparently:

- Acknowledge the difficult market conditions

- Explain what you evaluated and why you chose this path

- Provide tools to help employees understand their options

- Offer one-on-one support for employees with questions

Hold enrollment sessions: Whether you’re staying with your current carrier, moving to a PEO, or switching to ICHRA, employees need education and support.

The Uncomfortable Truth About 2026

Here’s what many benefits advisors won’t tell you directly: for small tech companies, the traditional employer-sponsored group health insurance model is becoming financially unsustainable.

About 90% of ACA policyholders, approximately 22 million people, receive enhanced premium subsidies. A sizeable share of those enrollees are self-employed or own or work at small businesses, with nearly half of adults in the individual health insurance market being self-employed or working at small businesses.

The market is telling us something: individual coverage with subsidies has become competitive with, and in some cases better than, small group coverage. Major carriers are exiting group markets and encouraging employers to explore ICHRAs as an alternative.

A recent survey found that 7% of small employers said their employees would get a better deal on the health insurance exchanges than through group coverage.

This doesn’t mean abandoning your responsibility to provide benefits. It means rethinking how you provide them.

What to Do Right Now

If you’re a tech company leader facing renewal in 2026:

- Don’t wait for your renewal notice. Start exploring alternatives now. The companies that will navigate this successfully are the ones planning 90+ days ahead.

- Challenge the assumption that traditional group coverage is your only option. Run the math on PEOs and ICHRAs with the same rigor you’d apply to any strategic decision.

- Focus on total employee cost, not just premium cost. A lower premium plan with a $5,000 deductible might actually cost employees more than a slightly higher premium plan with a $1,500 deductible.

- Consider this a strategic opportunity, not just a cost problem. The companies that figure out sustainable, competitive benefits structures now will have an advantage in recruiting and retention for years to come.

- Get expert help. This is too complex and too high-stakes to figure out alone. Aspireship can help you figure out which option makes the most sense for your company. Contact us today!

The Path Forward

The 2026 renewal season will be brutal for tech companies in the traditional small group market. But brutal doesn’t mean insurmountable.

The companies that will thrive are those willing to question assumptions, explore alternatives, and make bold decisions about how they provide benefits. Whether that means joining a PEO, exploring ICHRA, or finding a hybrid solution, the key is starting the conversation now.

Because three months from now, when that renewal notice arrives with a 15% increase, you’ll either have options or you’ll be stuck accepting whatever the market gives you.

Which position do you want to be in?

Ready to Explore Your Options?

At Aspireship, we help tech companies under 250 employees access enterprise-grade benefits through group buying power, often at lower costs than traditional renewals.

We’ve helped companies navigate brutal renewal seasons and come out with better coverage at sustainable costs. Whether you’re facing your first renewal or your tenth, we can show you what’s possible.

Learn more about Aspireship’s benefits solutions here.

Sources

- Peterson-KFF Health System Tracker. “How much and why premiums are going up for small businesses in 2026.” September 2025. https://www.healthsystemtracker.org/brief/how-much-and-why-premiums-are-going-up-for-small-businesses-in-2026/

- Kaiser Family Foundation. “Small Business Health Insurance Premiums Could Rise 11% in 2026: Analysis.” September 2025. https://www.kff.org/health-costs/how-much-and-why-premiums-are-going-up-for-small-businesses-in-2026/

- Venteur. “Small Business Health Insurance Costs 2026: A Guide.” December 2025. https://www.venteur.com/blog/how-much-and-why-premiums-are-going-up-for-small-businesses

- Center on Budget and Policy Priorities. “Health Insurance Premium Spikes Imminent as Tax Credit Enhancements Set to Expire.” November 2025. https://www.cbpp.org/research/health/health-insurance-premium-spikes-imminent-as-tax-credit-enhancements-set-to-expire

- StretchDollar. “9 Big Changes in Health Insurance for 2026.” 2025. https://www.stretchdollar.com/posts/9-big-changes-in-health-insurance-for-2026

- Fiscal Policy Institute. “New York’s Small Group Market Has Big Problems.” October 2025. https://fiscalpolicy.org/ny-small-group-market-has-big-problems

- healthinsurance.org. “My health insurance company is leaving my market. What can I do?” October 2025. https://www.healthinsurance.org/faqs/my-health-insurance-company-is-leaving-my-market-what-can-i-do/

- PeopleKeep. “Why Fewer Small Businesses Are Offering Group Health Insurance.” December 2025. https://www.peoplekeep.com/blog/why-fewer-small-businesses-are-offering-group-health-insurance

- StretchDollar. “Your Guide to the 2026 ACA Health Insurance Market.” 2025. https://www.stretchdollar.com/posts/your-guide-to-the-2026-aca-health-insurance-market

- CNN Politics. “These small-business owners will become uninsured after key ACA subsidies expire.” December 2025. https://www.cnn.com/2025/12/27/politics/small-businesses-health-insurance-aca

- PEO Focus. “What to Look For in PEO Health Insurance Renewals.” July 2024. https://www.peofocus.com/understanding-peo-health-insurance-renewals

- Connecticut Hospital Association. “ConnectiCare to exit fully insured large group market in CT.” June 2025. https://cthosp.org/daily-news-clip/connecticare-to-exit-fully-insured-large-group-market-in-ct/